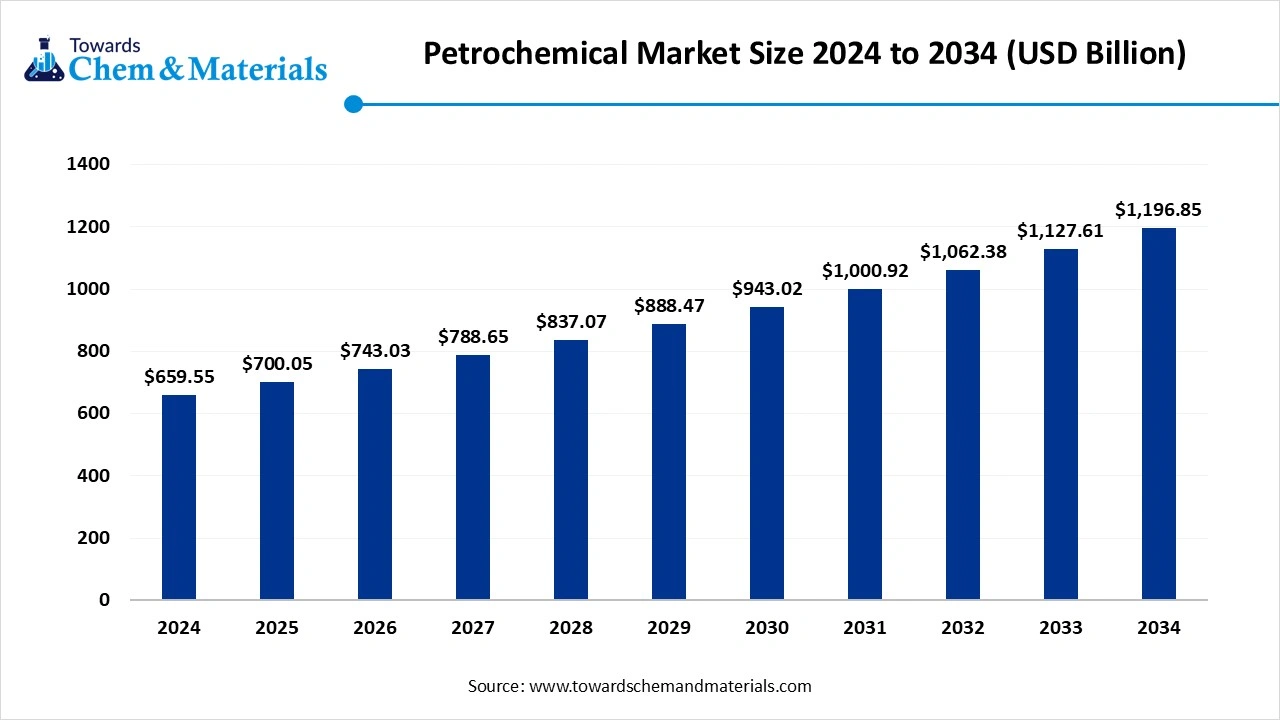

Petrochemical Market Size to Worth USD 1,196.85 Billion by 2034

According to Towards Chemical and Materials, the global petrochemical market size is calculated at USD 700.05 billion in 2025 and is expected to be worth around USD 1,196.85 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.14% over the forecast period 2025 to 2034.

Ottawa, Oct. 06, 2025 (GLOBE NEWSWIRE) -- The global petrochemical market size was valued at USD 659.55 billion in 2024 and is anticipated to reach around USD 1,196.85 billion by 2034, growing’s at a compound annual growth rate (CAGR) of 6.14% over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5523

Petrochemical Overview

The petrochemical market is evolving swiftly as demand continues to rise across packaging, automotive, construction, agriculture, and consumer goods applications. Manufacturers are focusing on expanding production capacity while optimizing feedstock flexibility to reduce supply risks and enhance cost efficiency. Regional dynamics are shifting as Asia Pacific strengthen its dominance, supported by abundant resources and favourable policy frameworks, while the Middle East is emerging as strategic hub for export-oriented production. At the same time, technological innovation and process modernization are reshaping operational strategies, with players increasingly investing in integration, circular solutions, and lower emission manufacturing routed to align with sustainability expectations. As value chains become more interconnected, partnerships, mergers, and long-term supply collaboration are playing a crucial in securing competitive advantage.

Market Report Highlights

- The Asia Pacific petrochemicals market size was estimated at USD 336.37 billion in 2024 and is projected to reach USD 611.11 billion by 2034, growing at a CAGR of 6.16% from 2025 to 2034.

- By region, Asia Pacific held approximately 51% share in the petrochemicals market in 2024.

- By product type, the olefins segment held approximately a 44% share in the market in 2024.

- By raw material, the crude oil segment held approximately a 52% share in the market in 2024.

- By manufacturing process, the steam cracking segment held approximately a 48% share in the market in 2024.

- By end-use industry, the packaging segment held approximately a 29% share in the market in 2024.

Buy Now this Premium Research Report at a Special Price Against the List Price With [Express Delivery] @ https://www.towardschemandmaterials.com/price/5523

Petrochemical Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 743.03 billion |

| Revenue forecast in 2034 | USD 1,196.85 billion |

| Growth rate | CAGR of 6.14% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2021 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative Units | Revenue in USD million/billion, Volume in Million tons and CAGR from 2025 to 2034 |

| Segments covered | By Product Type, By Raw Material, By Manufacturing Process, By End-Use Industry, By Region |

| Key companies profiled | BASF SE; Chevron Corporation; China National Petroleum Corporation (CNPC); China Petrochemical Corporation; ExxonMobil Corporation; INEOS Group Ltd.; LyondellBasell Industries Holdings B.V.; Royal Dutch Shell PLC; SABIC; Dow |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Key points:

- The petrochemical industry accounts for a significant and growing share of oil and gas demand and global greenhouse gas emissions.

- Nitrogen fertilisers represent 30% of the petrochemical industry’s emissions, and create a greenhouse gas 300 times more potent than carbon dioxide.

- Excluding fertiliser, 63% of petrochemical output is plastics – more than a third of which is used in packaging.

- Demand for oil by the plastic and petrochemical industries is set to double by 2050 under a business as usual scenario, leading to emissions well above what is required to limit warming to 1.5°C.

- China’s petrochemical industry is expanding rapidly – in five years it will add more capacity than currently exists in Europe, Japan and South Korea combined.

- Many petrochemical products, including plastics, contain chemicals that have been linked to health conditions in humans including cancer, neurodevelopmental harm and infertility.

- Tackling the climate impacts of plastics requires careful consideration of knock-on impacts of policy or regulatory changes, as well as a focus on reusing materials and reducing the amount of single-use materials that are produced, rather than purely on recycling or substituting plastics for other materials.

Here Are Some of The Top Products in the Petrochemical Market

- Ethylene- Key building block for polyethylene, PVC, ethylene oxide; most produced petrochemical.

- Propylene- Used in polypropylene, acrylonitrile, propylene oxide, and cumene production.

- Methanol- Used in formaldehyde, acetic acid, MTBE, and fuels; growing use in energy applications.

- Benzene- Base for styrene, phenol, aniline, and nylon; derived from crude oil reforming.

- Xylenes (para-xylene)- Key for polyester (PET) production; derived from catalytic reforming.

- Toluene- Used in solvents, TDI (for polyurethane), and as a gasoline additive.

- Butadiene- Critical for synthetic rubber and elastomers (e.g., SBR, ABS).

- Polyethylene (PE)- Widely used plastic (HDPE, LDPE); in packaging, containers, films, etc.

- Polypropylene (PP)- Versatile plastic for automotive, textiles, packaging; high chemical resistance.

- Styrene- Used in polystyrene, ABS, SBR rubber; essential for packaging and insulation materials.

What Are the Major Trends in the Petrochemical Market?

- Shift towards alternative and flexible feedstocks such as natural gas, bio-based sources, and recycled materials to mitigate reliance on conventional crude oil.

- Increasing integration of advanced process technologies (e.g. methanol to olefin, new catalytic routes) to improve efficiency and cost structure.

- Focus on sustainability, circular economy, and emissions reduction, pushing investment in low-carbon processes and recycling initiatives.

- Regional strategy shifts with rising role of Asia Pacific and expansion in Middle East and Africa as key hubs for capacity and exports.

How Does AI Influence the Growth of the Petrochemical Market In 2025?

AI is reshaping the petrochemical market in 2025 by transforming how facilities operate, plan, and innovate. Advanced algorithms support real time monitoring and predictive maintenance, helping operators detect anomalies before failures occur and extending the lifespan of critical equipment. Process optimization tools powered by machine learning continuously adjust temperature, pressure, and feedstock inputs to achieve higher output quality with lower energy use. In research and development, AI accelerates the discovery of new polymers and catalyst systems by simulating chemical interactions that would traditionally take months of experimentation. Beyond plant operations, AI strengthens logistics and procurement strategies by forecasting demands shifts, managing inventory flows, and selecting optimal transportation routes. As environmental regulations tighten, AI enabled monitoring systems allow petrochemical producers to track emissions and waste streams with greater accuracy, enabling better compliance planning and transparency.

Petrochemical Market Growth Factors

Can Recycling Technologies Spark a Petrochemical Comeback?

Investment from major players like Shell and ExxonMobil into large scale plastic chemical recycling facilities is opening a new revenue loop for petrochemical producers. Instead of relying solely on virgin feedstocks, companies are now converting waste plastics back into usable petrochemical inputs. This shift is helping operators cut raw material risk while aligning with tightening environmental expectations. As public pressure grows against plastic waste, petrochemical firms that integrate recycling technologies are gaining stronger social and regulatory acceptance. The ability to turn trash into profitable feedstock is quickly becoming a competitive advantage.

Will Aviation Fuel Alternatives Redefine Petrochemical Demand?

The aviation sector is under heavy pressure to decarbonisation, and airlines are turning to synthetic aviation fuels made from petrochemicals derivatives as a short term solution. Unlike full electrification, synthetic fuels slot directly into existing engines and infrastructure, creating a readymade market boost for petrochemical based intermediates. Energy companies are partnering with airlines to scale up production using gas to liquids and bio-naphtha blending techniques. This collaboration blurs the line between traditional fossil sectors are margining clean energy pathways. As flight demand grows, petrochemicals could quietly power aviation’s green transition from behind the scenes.

Market Opportunity

Could Joint Ventures Redefine Regional Strength?

Major energy and chemical players are forming new joint ventures to build integrated refining petrochemical complexes in growth regions, boosting local value chains and lowering logistics barriers. For example, Armco, Sinopec, and Yaser signed an agreement to expand petrochemical operations in Saudi Arabia, positioning themselves closer to feedstock sources and end markets. Such collaborations help share technical risk, pool capital, and accelerate execution in challenging environments. Local governments often welcome these alliances through incentives, further improving project viability. These ventures offer petrochemical forms a way to expand presence in strategic geographies more efficiently.

Is Infrastructure Upgrades Creating New Value?

Petrochemical operators are investing heavily in upgrading refining and pipeline infrastructure to improve feedstock flexibility and operation resilience. For instance, Aster Chemicals is investing in mooring and pipeline upgrades near a major refinery of restore direct crude deliveries and reduce dependency on intermediaries. Enhanced infrastructure enables faster throughput, reduced transport costs, and better access to diverse crude grades. It also supports resilience during supply disruptions, giving firms more control over their input sources. As gaining global infrastructure is modernized, petrochemical players who master retrofits and optimizations can unlock new margin opportunities.

Limitations In the Petrochemical Market

- The petrochemical industry remains highly sensitive to fluctuations in raw material costs, particularly those derived from crude oil and natural gas. Such volatility can disrupt production schedules, effect profit margins, and complicate long-term planning. Additionally, geopolitical tensions and natural disasters can further exacerbate these uncertainties, leading to supply chain disruptions and increased operational risks.

- Stringent environmental regulations are imposing significant compliance costs on petrochemical producers. Adapting to these regulations often requires substantial investments in cleaner technologies and processes. Failure to meet these standards can result in legal penalties, reputational damage, and potential market access restrictions, all of which can hinder business growth and profitability.

Petrochemical Market Segmentation

Product Types Insights

Why Did The Olefins Segment Dominate The Petrochemical Market?

The olefins segment emerged as the dominant product type in 2024, capturing a substantial market share. This dominance can be attributed to the increasing production of various polymers and plastics, which significantly boosts the demand for olefins. The presence of vast reserves of natural gas and the growing development of lightweight vehicle materials further contribute to the growing development of lightweight vehicle materials further contribute to the rising demand for olefins. Additionally, the expanding packaging industry and the rise in construction activities have led to an increased adoption of olefins, thereby driving the overall market growth. The versatility and wide range of applications of olefins in various industries underscore their pivotal role in the petrochemical sector.

The polypropylene and bio-based olefins segment is identified as the fastest growing product type in the market during the forecast period. This rapid growth is driven by the expanding packaging industry and increasing construction activities, which elevate the demand for polypropylene. Moreover, the rising production of automotive components, films and containers further fuels the demand for polypropylene. The growing environmental concerns and the implementation of stricter environmental regulations have led a heighted adoption of bio-based olefins. As they offer a more sustainable alternative to traditional petrochemical products. The focus on reducing carbon footprints and minimizing greenhouse as emissions supports the market growth of bio-based olefins, making them a key area of interest in the petrochemical sector.

Raw Material Insights

How Did The Crude Oil Segment Hold The Largest Share In The Petrochemical Market?

The crude oil segment held the largest revenue share in the market in 2024. Primarily due to its abundant availability and cost effectiveness as a feedstock. The utilization of crude oil in various petrochemical processes, such as steam cracking, facilitates the production of essential chemicals and polymers. The increasing demand for synthetic fibres, detergents, and plastics has further amplified the need for crude oil as a raw material. Additionally, the high availability of feedstocks and the growth in industries like consumer goods, packaging, and construction have driven the demand for crude oil, thereby propelling the overall market growth.

The natural gas and naphtha alternatives segment is witnessing the fastest growth in the petrochemical market during the forecast period. The increasing demand for products like clothing, plastics, and fertilizers has escalated the adoption of natural gas as a feedstock. The abundance and cost –effectiveness of natural gas, coupled with advancements in extraction technologies, have made it an attractive alternative to traditional raw materials. Furthermore, the growing environmental concerns and the shift towards cleaner processes have accelerated the adoption of natural gas and the naphtha alternatives, supporting the overall market growth.

Manufacturing process Insights

Why Did The Steam Cracking Segment Dominate The Petrochemical Market?

The steam cracking segment dominated the market in 2024, accounting for a significant share due to its efficiency and versatility in producing light olefins. Steam cracking involves the thermal decomposition of hydrocarbons, such as naphtha and ethane, at high temperature, yielding valuable products like ethylene and propylene. The increasing production of light olefins and the growing processes of hydrocarbon feedstock have heightened the demand for steam, cracking. Moreover, the widespread use of steam cracking in manufacturing ethane, naphtha, and liquefied petroleum gas (LPG) further underscored it importance in the petrochemical industry. The cost-effectiveness and scalability of steam cracking processes drive it dominance in the market.

The methanol to olefins (MTO) segment is identified as the fastest growing manufacturing process in the market during the forecast period. The increasing need for construction materials and the production of automotive components have elevated the demand fir MTO processes. MTO technology offers a pathway to convert methanol, derived from natural gas or coal, into valuable olefins like ethylene and propylene. The focus on energy security and the presence of diverse feedstocks have further fuelled the adoption of MTO processes. Additionally, the strong emphasis on reducing oil dependency and minimizing carbon footprints has accelerated the adoption of MTO technology, supporting its rapid growth in the market.

End Use Industry Insights

Which End Use Dominated The Petrochemical Market In 2024?

The packaging sector emerged as the dominant end use industry in the market in 2024, accounting for a substantial revenue share. The growing demand for packaged goods and the increasing consumption of packaged food have significantly elevated the need for petrochemical products. The rise in the e-commerce sector and the focus on extending the shelf life of packaged products have further driven the adoption of petrochemicals in packaging applications. The versatility and protective properties of petrochemical based packaging materials make them a preferred choice across various industries, thereby propelling the overall market growth.

The automotive sector is identified as the fastest growing end use industry in the petrochemical market during the forecast period. The increasing demand for lightweight automotive components, such as fuel tanks, bumpers, and interior panels, has elevated the need for petrochemical products. Polymer based materials offer advantages like reduced vehicle weight, improved fuel efficiency, and enhanced safety, making them integral to modern automotive manufacturing. the growth in vehicle production and the emphasis on sustainable automotive solution have further fuelled adoption of petrochemical materials in the automotive sector. These factors collectively contribute to the rapid growth of the automotive sector in the market.

Regional Insights

Which Region Dominates the Petrochemical Market?

Asia Pacific dominated the market in 2024. This dominance is driven by rapid industrialization, robust manufacturing sectors, and substantial consumer demand across countries like China, India, and Japan. The region’s extensive infrastructure and investment in petrochemical facilitates further bolster its leading status. Additionally, Asia Pacific’s strategic initiatives in recycling and bio-based alternatives are addressing environmental concerns, ensuring sustainable growth. As a result, Asia Pacific remains the epicentre of petrochemical production and consumption.

China’s dominance in the petrochemical market is attributed to its advanced refining capabilities for domestic manufacturing infrastructure has been pivotal in the industry’s expansion. China’s commitment to adopting cutting-edge manufacturing technologies has enhanced efficiency and output. These factors collectively position China as a central hub in the global petrochemical landscape.

Why Is Middle East and Africa emerging As the Fastest Growing Petrochemical Region?

Middle East and Africa is the fastest growing region in the petrochemical market. Countries like Saudi Arabia, Qatar, and the UAE are leveraging their abundant natural gas and crude oil reserves to expand production capacities. This growth is further supported by government initiatives aimed at diversifying economies and reducing reliance on crude oil exports. The development of advanced petrochemical facilities and the establishment of robust export infrastructures are enhancing the region’s competitiveness in the global market. As a result, MEA is poised to capture a significant share of the global market in coming years.

South Africa stands out within the MEA region due to its strategic investments in the petrochemical sector and its diversified industrial base. The country’s robust infrastructure, coupled with significant investments in oil refining and power generation, has bolstered its position as a key player in the market. Additionally, South Africa’s driving demand. Government support for industrial development and a focus on sustainable practices have also contributed to the growth of the petrochemical industry in the country. These factors collectively position South Arica as a dominant force in the MEA petrochemical landscape.

More Insights in Towards Chemical and Materials:

- Oil & Gas Market : The global Oil & Gas-market size was valued at USD 6.10 Trillion in 2024, grew to USD 6.33 Trillion in 2025, and is expected to hit around USD 8.79 Trillion by 2034, growing at a compound annual growth rate (CAGR) of 3.72% over the forecast period from 2025 to 2034.

- Oil & Gas Infrastructure Market : The global oil & gas infrastructure market size was reached at USD 752.19 billion in 2024 and is expected to be worth around USD 1,377.87 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.24% over the forecast period 2025 to 2034.

- AI in Chemicals Market : The global artificial intelligence in chemicals market size was valued at USD 2.19 billion in 2024 and is expected to reach around USD 28.74 billion by 2034, growing at a CAGR of 29.36% from 2025 to 2034.

- Chemical Intermediate Market : The global chemical intermediate market size is calculated at USD 118.19 billion in 2024, grew to USD 127.18 billion in 2025 and is predicted to hit around USD 246.1 billion by 2034, expanding at healthy CAGR of 7.61% between 2025 and 2034.

- Agrochemicals Market : The global agrochemicals market size accounted for USD 285.36 billion in 2024 and is predicted to increase from USD 300.91 billion in 2025 to approximately USD 485.13 billion by 2034, expanding at a CAGR of 5.45% from 2025 to 2034.

- Sustainability Chemical Market : The global sustainability chemical market size was reached at USD 80.77 billion in 2024 and is expected to be worth around USD 161.73 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.19% over the forecast period 2025 to 2034.

- PFAS Free Chemicals Market : The global PFAS free chemicals market volume was valued at 211.23 kilo tons in 2024 and is expected to reach around 905.32 kilo tons by 2034, growing at a CAGR of 15.67% from 2025 to 2034.

- Lithium Chemicals Market : The global lithium chemicals market size was reached at USD 33.19 billion in 2024 and is expected to be worth around USD 196.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 50% over the forecast period 2025 to 2034.

- Textile Chemicals Market : The global textile chemicals market volume is expected to produce approximately 1.52 million tons in 2025, with a forecasted increase to 2.46 million tons by 2034, growing at a CAGR of 5.49% from 2025 to 2034.

- Waterproofing Chemicals Market : The waterproofing chemicals market size accounted for USD 7.85 billion in 2024 and is predicted to increase from USD 8.39 billion in 2025 to approximately USD 15.23 billion by 2034, expanding at a CAGR of 6.85% from 2025 to 2034.

- Industrial Gas Pipeline Infrastructure Market : The global industrial gas pipeline infrastructure market volume was reached at USD 44.00 million tonnes in 2024 and is expected to be worth around USD 67.55 million tonnes by 2034, growing at a compound annual growth rate (CAGR) of 4.38% over the forecast period 2025 to 2034.

- Natural Gas Market : The global natural gas market size accounted for USD 4.19 trillion in 2024 and is predicted to increase from USD 4.41 trillion in 2025 to approximately USD 6.96 trillion by 2034, expanding at a CAGR of 5.20% from 2025 to 2034.

- Renewable Natural Gas Market : The global renewable natural gas market size is calculated at USD 15.5 billion in 2025 and is forecasted to reach around USD 31.37 billion by 2034, accelerating at a CAGR of 8.15% from 2025 to 2034.

- Gas Separation Membrane Market : The global gas separation membrane market was valued at approximately USD 1.85 billion in 2024 and is projected to grow at a CAGR of 6.95% from 2025 to 2034, reaching a value of USD 3.62 billion by 2034.

-

U.S. Specialty Oleochemicals Market : The U.S. specialty oleochemicals market size accounted for USD 4.23 billion in 2024 and is predicted to increase from USD 4.57 billion in 2025 to approximately USD 9.23 billion by 2034, expanding at a CAGR of 8.11% from 2025 to 2034.

Petrochemical Market Top Key Companies:

- BASF SE

- Dow Chemical Company

- SABIC

- LyondellBasell Industries

- ExxonMobil Chemical

- INEOS Group

- Sinopec

- Reliance Industries Limited (RIL)

- Shell Chemicals

- TotalEnergies Chemicals

- Formosa Plastics Group

- Mitsubishi Chemical Group

- LG Chem

- Covestro AG

- Braskem S.A.

- Arkema S.A.

- Chevron Phillips Chemical

- PTT Global Chemical

- Mitsui Chemicals

- Hanwha Solutions

Recent Developments

- In October 2025, Warner Buffett’s Berkshire Hathaway is nearing a $10 billion deal to acquire Occidental Petroleum’s petrochemical unit, OxyChem. This move aligns with Berkshire’s strategy of investing is undervalued assets and Occidental’s efforts to reduce its significant debt load. The acquisition is poised to strengthen Berkshire’s portfolio in the chemical sector.

- In October 2025, Taiwan has become the largest importer of Russian, importing 1.9 million tonnes in the first held of the year. This sharp increase has raised concerns about Taiwan’s economic and national security, given China’s close ties to Russia and its claims over Taiwan.

Petrochemical Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Petrochemical Market

By Product Type

- Olefins (Ethylene, Propylene, Butadiene)

- Aromatics (Benzene, Toluene, Xylene)

- Methanol & Derivatives

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Synthetic Rubber

- Bio-Based Olefins

- Others (Acetylene, Butanes, Styrene)

By Raw Material

- Crude Oil

- Natural Gas

- Naphtha

- Others (LPG, Coal-derived feedstocks)

By Manufacturing Process

- Steam Cracking

- Catalytic Reforming

- Methanol-to-Olefins (MTO)

- Others (Gas-to-Liquid, Bio-based Processes)

By End-Use Industry

- Packaging

- Automotive & Transportation

- Construction & Infrastructure

- Textiles & Apparel

- Consumer Goods

- Electrical & Electronics

- Industrial Manufacturing

- Agriculture & Fertilizers

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5523

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.