North America Adhesives and Sealants Market Size to Worth USD 27.50 Bn by 2035

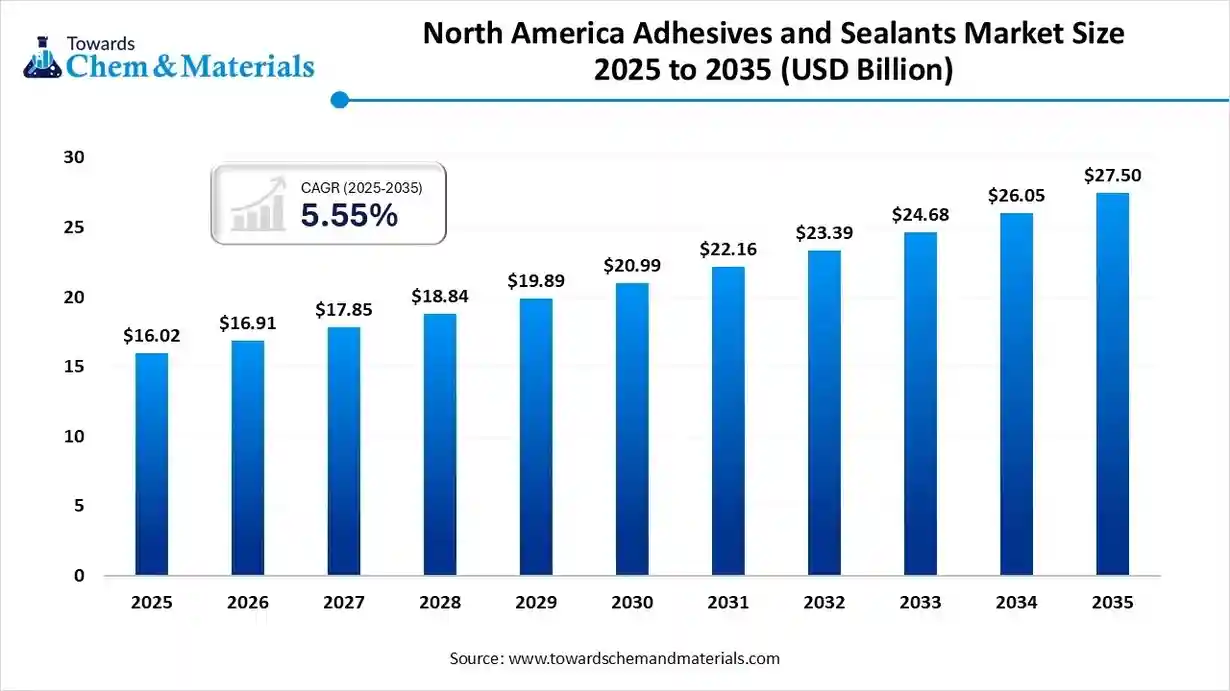

According to Towards Chemical and Materials Consulting, The North America adhesives and sealants market size was estimated at USD 16.02 billion in 2025 and is expected to be worth around USD 27.50 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.55% over the forecast period from 2026 to 2035.

Ottawa, Dec. 18, 2025 (GLOBE NEWSWIRE) -- The North America adhesives and sealants market size is calculated at USD 16.02 billion in 2025 and is predicted to increase from USD 16.91 billion in 2026 and is projected to reach around USD 27.50 billion by 2035, The market is expanding at a CAGR of 5.55% between 2026 and 2035. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6040

What are Adhesives and Sealants in North America

The North America adhesives and sealants market is growing due to rising demand from construction, automotive, and packaging industries, supported by a shift toward lightweight materials, durable bonding solutions, and sustainable, low-VOC formulations. The expansion of e-commerce and ongoing infrastructure development further strengthen market adoption, keeping the region on a steady growth path.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

North America Adhesives And Sealants Market Report Highlights

- By adhesive technology, the water-based segment accounted for the largest revenue share of 33.51% in 2025.

- By adhesive product, the acrylic adhesives segment dominated with the largest revenue share of 41.72% in 2025.

- By adhesive application, the paper and packaging segment dominated with the largest revenue share of 35.41% in 2025.

- By sealant product, the Silicones segment accounted for the largest revenue share of 39.19% in 2025.

- By sealant application, the construction segment dominated with the largest revenue share of 43.22% in 2025.

The Basics of Adhesives and Sealants: Understanding the Different Types and Their Applications

Adhesives

Adhesives are substances used to bond two surfaces together. They come in various forms and are selected based on the materials to be joined and the conditions to which the bond will be exposed.

How Adhesives and Sealants Help Reduce Costs and Improve Efficiency in Manufacturing

Adhesive and sealants are essential materials used in various manufacturing industries for bonding and sealing applications. They provide numerous benefits, including improved efficiency, reduced costs, and increased durability. Here are some ways adhesives and sealants help reduce costs and improve efficiency in manufacturing:

Bonding Capabilities

- adhesive and sealants have superior bonding capabilities compared to traditional mechanical fastening methods. This reduces the need for additional fasteners, such as screws or bolts, which can lead to cost savings.

- adhesive and sealants also distribute stresses evenly across the bond line, reducing the likelihood of failure and increasing durability.

Increased Efficiency

- Adhesives and sealant allow for faster and more efficient assembly processes. They can be applied in a continuous line or pattern, reducing the need for individual fasteners and improving assembly time.

- Adhesives and sealant also eliminate the need for drilling or punching holes in materials, which can save time and reduce material waste.

Reduced Material Waste

- Adhesives and sealant create a strong bond with less material than traditional fastening methods, resulting in less material waste.

- Additionally, adhesives and sealants can bond dissimilar materials together, reducing the need for additional materials to create a mechanical bond.

Improved Product Quality

- Adhesives and sealant provide consistent bonding and sealing, resulting in improved product quality.

- They can also provide additional benefits, such as vibration damping and noise reduction, improving the overall performance of the product.

Types of Adhesives:

1. Epoxy:

- Description: A two-part adhesive consisting of a resin and a hardener.

- Properties: Strong, durable, and resistant to chemicals and high temperatures.

- Applications: Metal bonding, repair of concrete and ceramics, and in aerospace industries.

2. Cyanoacrylate (Super Glue):

- Description: A fast-drying adhesive that forms a strong bond almost instantly.

- Properties: Bonds well to plastics, metals, and rubber; tends to be brittle.

- Applications: Small repairs, crafts, and quick fixes.

3. Polyurethane:

- Description: A versatile adhesive that expands as it cures.

- Properties: Flexible, strong, and resistant to moisture and UV light.

- Applications: Woodworking, construction, and automotive repairs.

4. Silicone Adhesive:

- Description: A rubber-like adhesive that remains flexible after curing.

- Properties: Waterproof, temperature-resistant, and flexible.

- Applications: Sealing gaps, bonding glass, and in automotive and construction applications.

5. Acrylic Adhesive:

- Description: An adhesive that can be either pressure-sensitive or structural.

- Properties: Good resistance to environmental factors and has a strong bond.

- Applications: Automotive trims, signage, and industrial applications.

6. Contact Adhesive:

- Description: Applied to both surfaces and allowed to dry before bonding.

- Properties: Strong immediate bond and resistant to water.

- Applications: Laminate bonding, rubber, and leather.

Sealants

Sealants are used to fill gaps and cracks to prevent the passage of fluids, air, or other substances. They help to protect surfaces and enhance the durability of structures.

Types of Sealants:

1. Silicone Sealant:

- Description: A flexible, rubber-like sealant.

- Properties: Excellent for waterproofing and resisting temperature extremes.

- Applications: Windows, doors, and bathroom fixtures.

2. Polyurethane Sealant:

- Description: A strong, flexible sealant that adheres well to various substrates.

- Properties: High durability and resistance to weathering.

- Applications: Construction joints, automotive, and flooring.

3. Acrylic Sealant:

- Description: A paintable sealant that is easy to work with.

- Properties: Less flexible but good for indoor use and can be painted over.

- Applications: Interior gaps and joints, and moldings.

4. Butyl Sealant:

- Description: A thick, sticky sealant that forms a strong, long-lasting bond.

- Properties: Excellent for sealing joints and is highly resistant to water.

- Applications: Roofing, automotive, and weatherproofing.

5. Hybrid Sealants:

- Description: Combine properties of different sealant types (e.g., silicone and polyurethane).

- Properties: Versatile and can offer both flexibility and strength.

- Applications: General construction, automotive, and industrial applications.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6040

North America Adhesives And Sealants Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 16.91 Billion |

| Revenue forecast in 2035 | USD 27.50 Billion |

| Growth rate | CAGR of 5.55% from 2026 to 2035 |

| Actual data | 2021 - 2025 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Revenue in USD Million/billion, volume in kilotons, and CAGR from 2026 to 2035 |

| Report coverage | Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends |

| Segments covered | By Adhesives Technology, By Adhesives Product, By Adhesives Application, By Sealants Product, By Sealants Application |

| Country scope | U.S., Canada, Mexico |

| Key companies profiled | Henkel Corporation; Sika AG; 3M; H.B. Fuller Company; Evonik Industries; RPM International Inc.; Dow; Wacker Chemie AG; Arkema; Arkema Group |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Adhesives and Sealants Market Size | Companies Analysis 2026- 2035

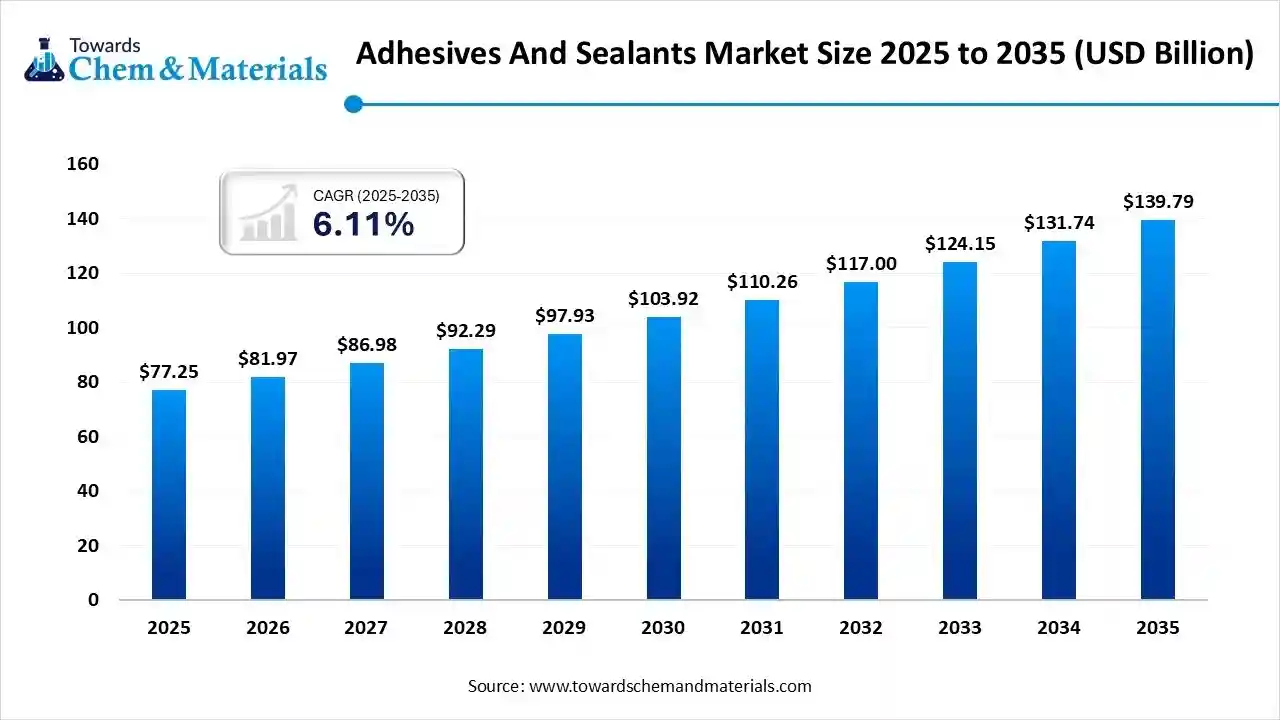

The global adhesives and sealants market size is calculated at USD 77.25 billion in 2025 and is predicted to increase from USD 81.97 billion in 2026 and is projected to reach around USD 139.79 billion by 2035, The market is expanding at a CAGR of 6.11% between 2026 and 2035. Asia Pacific dominated the adhesives and sealants market with a market share of 38.12% the global market in 2025. The growing infrastructure development and expansion of the packaging sector drive market growth.

The adhesives and sealants market growth is driven by growing construction activities, innovation in agriculture practices, the rise in adoption of electric vehicles, rapid expansion of e-commerce, increasing use of consumer electronics, and the shift from mechanical fasteners. The increasing development of large-scale infrastructure projects like roads, highways, airports, bridges, and others increases demand for adhesives & sealants.

The growing environmental concerns and increasing consumer awareness about eco-friendly products increase the development of sustainable sealants & adhesives. The innovations, like high-strength hybrid resins and sustainable water-based systems, support the expansion of the adhesives & sealants industry.

Asia Pacific Adhesives and Sealants Market Size to Surpass USD 59.50 Bn by 2035

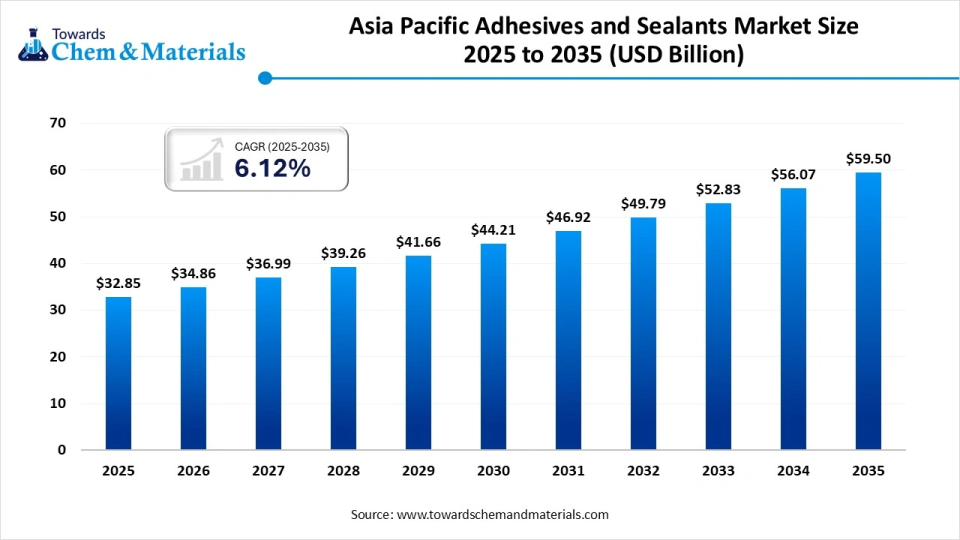

The Asia Pacific adhesives and sealants market size is calculated at USD 32.85 billion in 2025 and is predicted to increase from USD 34.86 billion in 2026 and is projected to reach around USD 59.50 billion by 2035, The market is expanding at a CAGR of 6.12% between 2026 and 2035. The medical device manufacturing expansion and the development of infrastructure projects drive market growth.

The Asia Pacific adhesives and sealants market growth is driven by the growing development of transportation infrastructure, the increasing number of vehicles, the booming e-commerce sector, the rise in electronics manufacturing, and rising industrial activities.

The increasing investment in construction projects like commercial spaces, new houses, and large-scale infrastructure in countries like India and China increases demand for adhesives and sealants for purposes like roofing, insulation, flooring, and glazing. The high availability of raw materials and low production cost increases the production of adhesives and sealants in the Asia Pacific.

Adhesives are used to create a strong bond between materials. They offer a rigid feel & high strength. Adhesives come in diverse forms like tapes, liquids, and pastes. Adhesives like epoxy resins, acrylics, and polyurethanes are widely used across the Asia Pacific region for diverse applications. The rapid urbanization and industrialization in countries like Japan, China, and India increase demand for adhesives.

U.S. Adhesives and Sealants Market Size and Growth 2025 to 2034

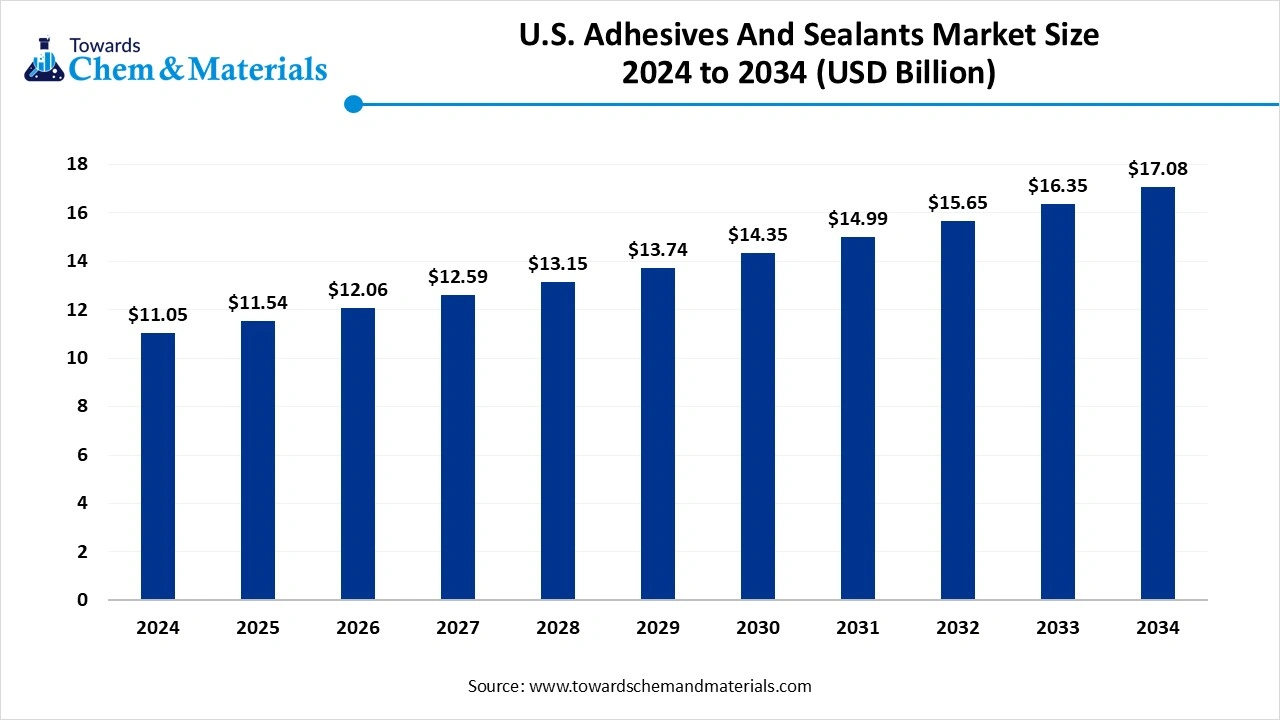

The U.S. adhesives and sealants market size was valued at USD 11.54 billion in 2025, grew to USD 12.06 billion in 2026, and is expected to hit around USD 17.08 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.45% over the forecast period from 2025 to 2034.

The growing automotive industry and the rise in infrastructure development drive the growth of the market. U.S. adhesives and sealants are chemical formulations used to join, protect, bond, or seal surfaces in various applications. Adhesive bonds objects together, whereas sealants fill joints & seams. The various types of adhesives & sealants present in the United States are epoxy, polyurethane, cyanoacrylate, acrylic, silicone, and VAE. Adhesive & sealants secure bonding, offer smooth finishes, reduce rework, extend product life, and protect from environmental hazards.

They are widely used in applications like weatherproofing doors & windows, preventing leaks in engines, bonding plastic or metal frames in smartphones, and securing packaging materials. Factors like growing infrastructural and residential construction activities, rise in electric vehicles, expansion of the packaging industry, growth in home improvement projects, increasing adoption of lightweight vehicle materials, and growing demand for household appliances contribute to the growth of the U.S. adhesives and sealants market.

North America Government Initiatives for the Adhesives and Sealants Industry:

- U.S. EPA Volatile Organic Compound (VOC) Regulations: The Environmental Protection Agency (EPA) enforces stringent regulations under the Architectural Sealants Rule that compel manufacturers to produce eco-friendly products with low or no VOC levels to improve air quality.

- Infrastructure Investment and Jobs Act (United States): This act, which includes a $1.2 trillion investment in infrastructure improvements, drives demand for high-performance, durable adhesives and sealants used in modern construction and maintenance projects.

- Promotion of Lower-VOC Adhesives Initiative (United States): In January 2024, the EPA launched an initiative offering grants worth $200 million for companies that adopt sustainable adhesive technology in construction and manufacturing, directly incentivizing the transition to greener formulations.

- Toxic Substances Control Act (TSCA) Risk Evaluation (United States): The EPA uses the TSCA to evaluate and ban specific toxic chemicals, such as trichloroethylene (TCE), used in certain adhesives, ensuring the phase-out of hazardous substances from the market.

-

Green Building Standards and Certifications (North America): Government bodies and associated councils like the U.S. Green Building Council promote green building initiatives (e.g., LEED certification), which require the use of adhesives and sealants with certified low VOC emissions to ensure healthier indoor air quality in new construction.

What Are the Major Trends in the North America Adhesives and Sealants Market?

1. Shift Toward Sustainable, Low-VOC Formulations

Manufacturers are increasingly adopting bio-based, waterborne, and low-VOC chemistries to meet tightening environmental regulations and customer sustainability goals. This trend is driving innovation in greener adhesive systems for automotive, construction, and packaging applications.

2. Rapid Integration of Automation and AI in Manufacturing

Producers are leveraging AI-driven formulation tools, automated dispensing, and smart quality-control systems to improve consistency and reduce production costs. These technologies also accelerate product development cycles, giving companies a competitive edge.

3. Growing Demand for High-Performance Adhesives in EVs and Electronics

The expanding electric vehicle and electronics sectors are driving the need for lightweight, thermally conductive, and structurally strong adhesive solutions. This trend is increasing investment in advanced materials that enhance durability, heat management, and component integration.

How Does AI Influence the Growth of the North America Adhesives and Sealants Industry in 2025?

AI is accelerating the growth of the North America adhesives and sealants industry in 2025 by optimizing formulation development through predictive modeling, enabling faster creation of high-performance, eco-friendly chemistries. It enhances production efficiency using real-time process automation, reducing waste, energy use, and variability in product quality. AI-enabled demand forecasting and supply-chain analytics help manufacturers respond quickly to market shifts, improving inventory management and delivery reliability.

Market Opportunity

Could Rising Electric Vehicle Battery Production Create a Big Boost for Adhesives?

The surge in electric vehicle battery manufacturing in North America is pushing for advanced adhesives and sealants built for battery assembly, thermal management, and module sealing. Recent expansion of specialized battery application centers shows that firms are preparing to support EV markets with scalable production-ready adhesive solutions.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6040

North America Adhesives And Sealants Market Segmentation Insights

Adhesive Technology Insights:

Why Water-Based Segment Dominated the North America and Sealants Market?

The water-based segment dominated the market in 2025. Water-based adhesives gained strong preference thanks to their lower environmental impact, ease of use, and suitability for a wide variety of substrates. Their growing popularity reflects increasing regulatory and consumer focus on eco-friendly and low-VOC products. Manufacturers and end-users turned to water-based solutions to meet sustainability goals while maintaining effective bonding performance across construction, packaging and general industrial applications.

The solvent-based segment is projected to grow at the fastest rate during the forecast period. Solvent-based adhesives are attracting interest for applications demanding high bond strength, chemical resistance, or fast curing times, qualities important in industrial manufacturing and specialised assembly operations. As demand rises in sectors such as automotive, heavy-duty manufacturing, and specialised packaging, solvent-based adhesives are positioned to expand rapidly. Their performance characteristics make them especially relevant where durability and robustness are critical.

Adhesive Product Insights:

Which Adhesive Product Segment Held the Dominating Share of the North America Adhesives and Sealants Market in 2025?

The acrylic adhesives segment held a dominating position in 2025. Acrylic adhesives are valued for their versatility, offering strong bonding across a range of materials, good weather resistance, and reliable performance under variable conditions. Their adaptability means they are used in many end-use industries, from construction to electronics packaging. The wide acceptance of acrylic adhesives makes them a dependable choice for manufacturers seeking consistent performance without compromising ease of application or environmental standards.

The ethylene vinyl acetate (EVA) adhesives segment is expected to grow at the fastest rate between 2025 and 2035. EVA adhesives are gaining traction due to their flexibility, good adhesion to various substrates, and compatibility with packaging and lightweight assembly processes. As demand grows in sectors such as packaging, textiles, and mass production of consumer goods, the flexibility and cost-effectiveness of EVA adhesives make them increasingly attractive. This trend signals a shift toward adhesives, making them increasingly attractive. This trend signals a shift toward adhesives that balance performance with efficiency and manufacturing convenience.

Adhesive Application Insights:

How Paper and Packaging Segment Dominated the North America Adhesives and Sealants Market in 2025?

The paper and packaging segment dominated the market in 2025. The packaging industry’s expansion, driven by consumer demand, e-commerce growth, and increased product distribution, made packaging adhesives central to market demand. Adhesives for paper and packaging are widely used in carton sealing labels, and proactive wrapping, making them essential in supply chain and delivery services. Their broad applicability and consistent demand across retail, logistics, and manufacturing underscore why this segment held a strong position.

The furniture and woodworking segment is projected to expand rapidly during the forecast period. Growing interest in ready-to-assemble furniture, modular housing, and interior renovation is fuelling demand for adhesives suited for wood, laminates, and composite materials. As consumers and manufacturers opt for lightweight, cost-effective, and easy-to-assemble solutions in furniture and cabinetry, adhesives tailored for woodworking are seeing adoption. This trend reflects changing lifestyle preferences and growth in renovation and custom furniture markets.

Sealant Product Insights:

How Silicones Segment Leads the North America Adhesives and Sealants Market?

The silicones segment led the market in 2025. Silicone sealants are prized for their flexibility, durability, weather resistance, and strong sealing performance across a range of surfaces. Their reliability and versatility make them a go-to choose in construction, automotive, electronics, and general industrial applications. Because of these attributes, silicon sealants captured a major share of market demand, especially where long-term sealing and environmental resilience are required.

The acrylic sealants segment is expected to grow at the highest rate over the forecast period. Acrylic sealants are becoming popular for their ease of application, good adhesion to many substrates, and suitability for both indoor and outdoor sealing tasks. As builders and manufacturers increasingly seek cost-effective, versatile sealing solutions for construction, renovation, and packaging applications, acrylic sealants are emerging as a strong growth option. Their balance of performance and convenience is positioning them to gain wider market acceptance in the coming years.

Sealant Application Insights:

What Made the Construction Segment Dominate the North America Adhesives and Sealants Market?

The construction segment dominated the market in 2025. Sealants used in construction for sealing joints, waterproofing, insulation, and finishing remain indispensable as construction and infrastructure development continue across North America. The demand for reliable, durable sealing solutions in residential, commercial, and industrial building projects sustained the dominance of sealants in this sector. The breadth of applications in flooring, windows, doors, and structural joints ensures consistent demand from builders and contractors.

The packaging segment is projected to experience the fastest growth between 2025 and 2035. As packaging requirements evolve, driven by e-commerce, logistics expansion, and demand for secure, protective packaging, the need for effective sealants in packaging applications is rising. This includes sealants for carbon sealing, protective films, and barrier packaging where moisture resistance and secure sealing are critical. The growth of online retail and increased global shipping amplifies the demand for these sealing solutions, making packaging the fastest-growing application segment in the sealants category.

Country Insights

How Did the U.S. Perform in The North America Adhesives and Sealants Market in 2025?

The U.S. held the highest share of the market in 2025, supported by the expansion of its automotive industry, which continues to prioritise lightweight and electric vehicle production. The rise of e-commerce and the trend toward smaller, more compact electronic devices also strengthened demand for adhesives and sealants in both packaging and electronics applications.

Mexico Adhesives and Sealants Market Trends

Mexico is projected to be the fastest-growing market during the forecast period, driven by the rapid expansion of e-commerce and the increasing need for packaging solutions. The country’s shift toward energy-efficient construction and sustainable building methods is also boosting the use of advanced sealants.

Canada Adhesives and Sealants Market Trends

Canada is expected to expand at a strong pace as well, supported by rising adoption in packaging and electronics, linked with a growing preference for eco-friendly and bio-based products. Additionally, the surge in home renovation activities continues to fuel demand for adhesives and sealants in applications such as cabinetry, flooring and tiling.

Top Companies in the North America Adhesives and Sealants Market & Their Offerings:

- 3M provides a vast array of specialized industrial tapes and sealants for automotive, healthcare, and construction markets.

- H.B. Fuller Company offers a wide variety of adhesive technologies, from hot melts to reactive systems, for packaging, construction, and electronics applications.

- Evonik Industries supplies performance-enhancing additives and raw materials used in the formulation of other companies' adhesives and sealants.

- RPM International Inc. markets specialty coatings and sealants through well-known subsidiaries like DAP (consumer) and Tremco (professional).

- Dow provides foundational silicone and performance-based chemical raw materials for high-performance sealants and adhesives used across many industries.

- Wacker Chemie AG specializes in silicone chemistry, offering durable and flexible silicone-based binders and polymers for sealants resistant to UV rays and high temperatures.

- Arkema operates in the market via its Bostik brand, providing advanced adhesive and sealant technologies for construction, packaging, and consumer goods.

- Arkema Group is the parent company encompassing all of Arkema’s operations in specialty chemicals and advanced materials for bonding and sealing applications.

More Insights in Towards Chemical and Materials:

- Adhesives and Sealants Market Size to Surpass USD 139.79 Bn by 2035

- Aerospace Adhesives and Sealants Market Size to Hit USD 3.66 Bn by 2035

- Europe Adhesives and Sealants Market Size to Surpass USD 34.62 Bn by 2035

- Europe Construction Adhesives and Sealants Market Size to Surpass USD 9.39 Bn by 2035

- Asia Pacific Adhesives and Sealants Market Size to Surpass USD 59.50 Bn by 2035

- U.S. Adhesives and Sealants Market Size to Surge USD 17.08 Billion by 2034

-

North America Adhesives And Sealants Market Size to Hit USD 27.50 Bn by 2035

North America Adhesives And Sealants Market Top Key Companies:

- Henkel Corporation

- Sika AG

- 3M

- H.B. Fuller Company

- Evonik Industries

- RPM International Inc.

- Dow

- Wacker Chemie AG

- Arkema

- Arkema Group

Recent Developments

- In December 2025, 3 M launched a next-generation, e-beam curable epoxy structural adhesive for composite aircraft in the U.S. The product is integrated with electron beam technology to reduce curing time and minimize volatile organic compound (VOC) emissions.

- In February 2024, Henkel acquired Seal for Life Industries LLC - a supplier of protective coating and sealing solutions. This acquisition supports Henkel's growth platform for maintenance, repair, and overhaul (MRO), and will enable the company to offer a wider range of high-quality products to its customers

North America Adhesives And Sealants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2035. For this study, Towards Chemical and Materials has segmented the global North America Adhesives And Sealants Market

By Adhesives Technology

- Water based

- Solvent based

- Hot melt

- Other Technology

By Adhesives Product

- Acrylic

- Epoxy

- EVA

- Polyurethanes

- PVA

- Styrenic block

- Other Products

By Adhesives Application

- Automotive & Transportation

- Building & Construction

- Consumer & DIY

- Footwear & Leather

- Furniture & Woodworking

- Medical

- Paper & Packaging

- Other Products

By Sealants Product

- Silicones

- Polyurethanes

- Acrylic

- Polyvinyl acetate

- Other Products

By Sealants Application

- Construction

- Automotive

- Packaging

- Assembly

- Consumers

- Other Products

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6040

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | TCM Blog

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.